BeneFund Capital offers fast, flexible funding options across Lines of Credit, SBA Business Loans, and more — with built-in giving at no added cost.

BeneFund Capital offers fast, flexible funding options across Lines of Credit, SBA Business Loans, and more — with built-in giving at no added cost.

Up to $15M

Fast, flexible capital aligned with cash flow.

Up to $15M

Dedicated funding for sustainable growth and efficiency.

Up to $750K

Flexible funding line supporting cash flow needs.

Up to $100M

Turns invoices into working capital via revolving credit.

Up to $5M

Affordable SBA loans supporting business growth and investments.

Up to $20M

Leverages property equity to fund business growth.

Up to $10M

Flexible equipment financing for business growth.

Up to $100M

Inventory-backed revolving credit for scalable working capital.

Up to $500K

Eligibility requirements include a 700+ credit score on at least 2 of 3 bureaus, 5+ active revolving accounts

Up to $15M

Fast funding based on cash flow.

Up to $15M

Fixed-term funding with predictable payments.

Up to $750K

True revolver – use funds as needed

Up to $100M

Revolving credit tied to accounts receivable.

Up to $5M

Government-backend funding with long term.

Up to $20M

Residential • Commercial • Investment

Up to $10M

Purchase or lease new or used equipment.

$100K-$100M

Revolving line based on inventory value.

Up to $500K

Funding up to $500K for startups with strong personal credit.

Up to $10M

Subordinate financing up to $10M that strengthens capital without giving up control.

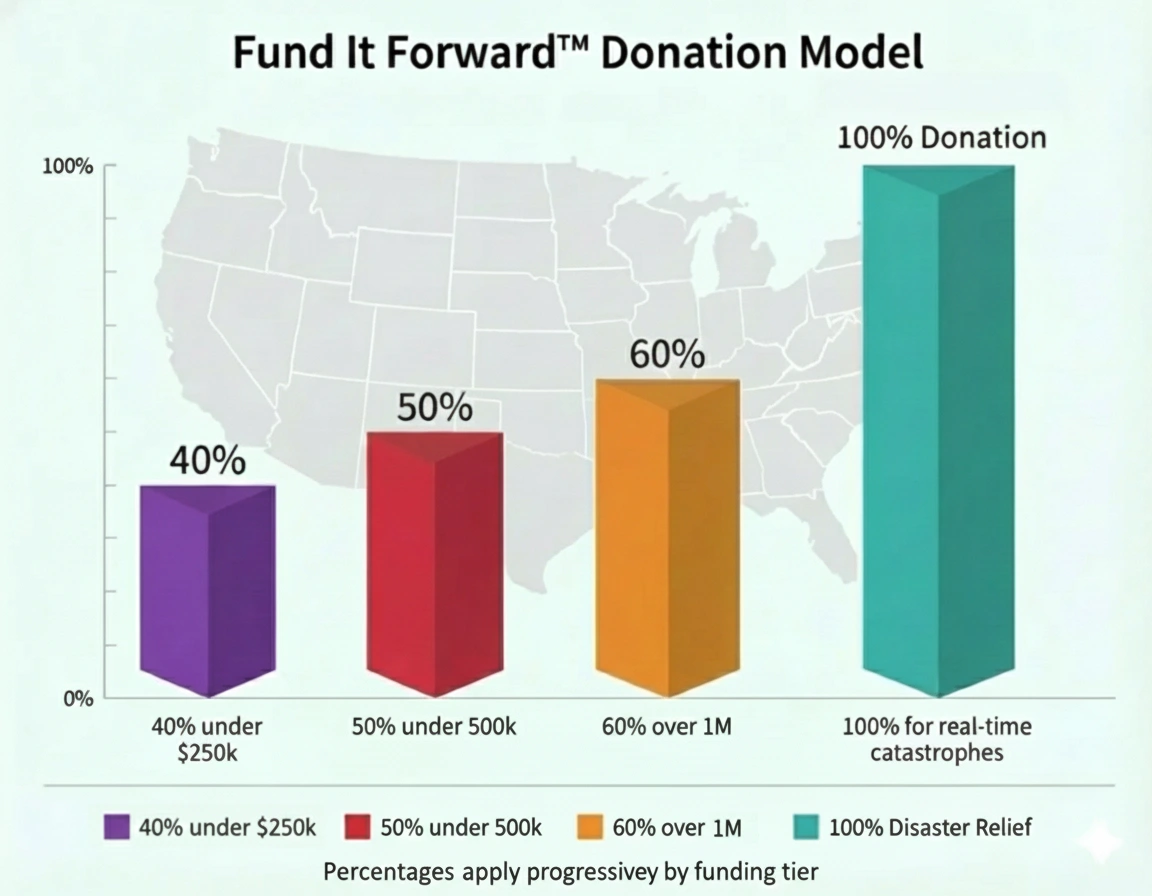

Transparent funding solutions with a built-in give-back model supporting vetted charitable initiatives

BeneFund empowers ethical, transparent business growth. Our Line of Credit blends flexibility with purpose—helping you maintain healthy cash flow while contributing to community impact. Every draw and repayment supports charitable giving, turning your financial strength into meaningful change.