Transparent business funding with built-in education and a give-back model supporting verified charitable initiatives — at no extra cost to the business

TRANSPARENCY • EDUCATION • COMMUNITY IMPACT

Ethical Lending With Community Impact — At No Extra Cost

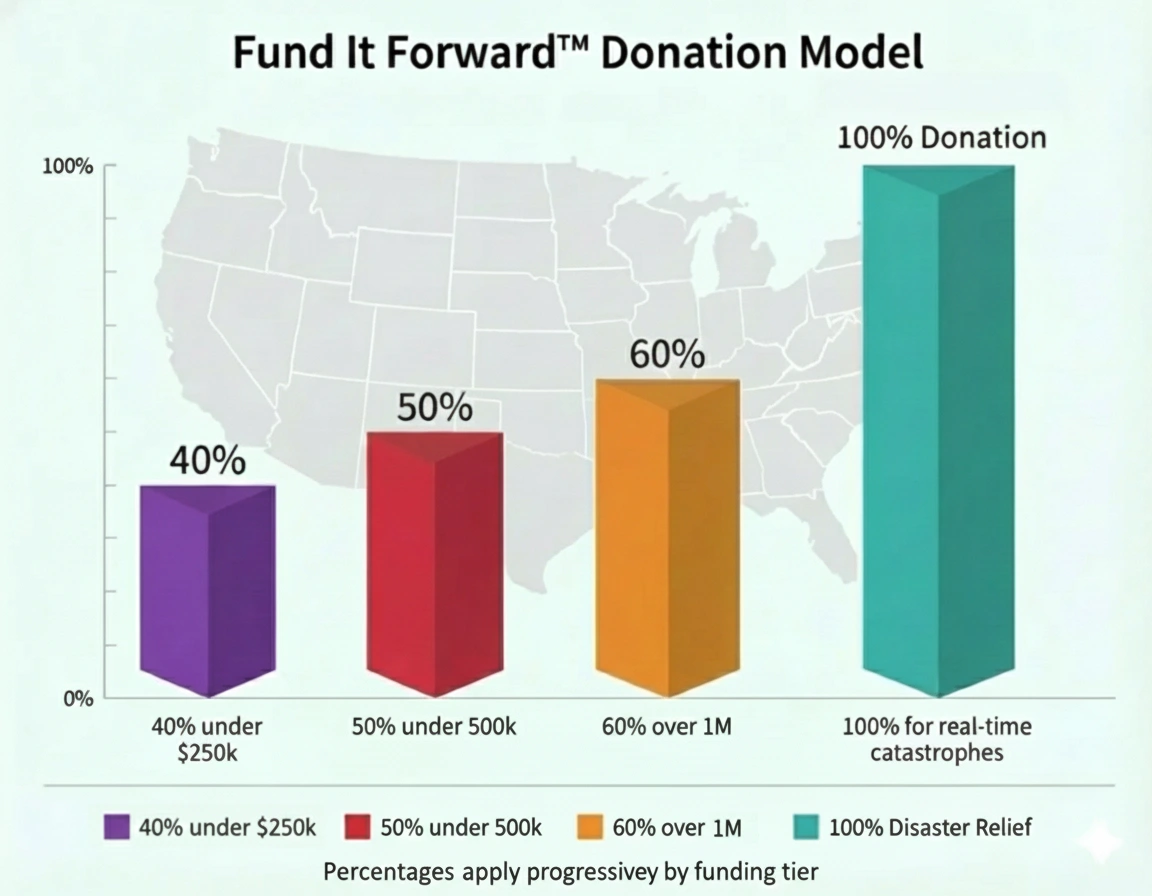

Fund It Forward is BeneFund Capital’s signature loan-program benefit that turns everyday lending activity into real community impact.

When a business secures a loan through BeneFund Capital, a portion of our earned commission may be voluntarily contributed to support nonprofit financial-education programs — all at zero cost to the borrower.

This is ethical lending with purpose, created to give entrepreneurs a transparent, trustworthy, community-driven loan experience.

Simple. Transparent. No Added Cost.

Partnering to identify the best financing option for your business.

Partnering to identify the best financing option for your business.

Partnering to identify the best financing option for your business.

Partnering to identify the best financing option for your business.

Partnering to identify the best financing option for your business.

Partnering to identify the best financing option for your business.

Hands-on support educating you about how deals and commissions work.

You sign a contract outlining terms and commission sharing.

You receive 55% to 70% of the deal’s commission as payment for facilitating the deal.

Your direct income is your commission that is donated to a choice of your charity on the Benefund Foundation registry.

A Loan Experience Built on Ethics and Transparency

Fund It Forward isn’t a gimmick or sales incentive — it’s a values-driven program that aligns business lending with public benefit without affecting your financial terms.

The Loan. The Terms. Plus a Positive Impact.

When you work with BeneFund Capital, you’re not just securing capital — you’re participating in a lending model built to protect entrepreneurs and uplift communities.

Lending Integrity You Can Rely On

Fund It Forward operates under strict compliance guidelines:

Experience a loan process built on trust, ethics, and community-driven values.

You get the capital you need — and together, we create meaningful impact.