Our responsive funding line supports ongoing cash flow needs with flexible access to capital, allowing you to draw funds only when needed. You pay interest solely on the amount used, maximizing cost efficiency. It’s ideal for managing working capital or pursuing new business opportunities, and it includes a built-in charitable giving component that offers subtle tax benefits while enhancing social impact.

Access a credit limit that grows with your business cash flow.

Get funds within hours to remove roadblocks to growth.

Each payment restores available credit—keep your capital in motion.

Choose weekly or monthly schedules that match your business rhythm.

Interest applies only to what you draw—no wasted cost.

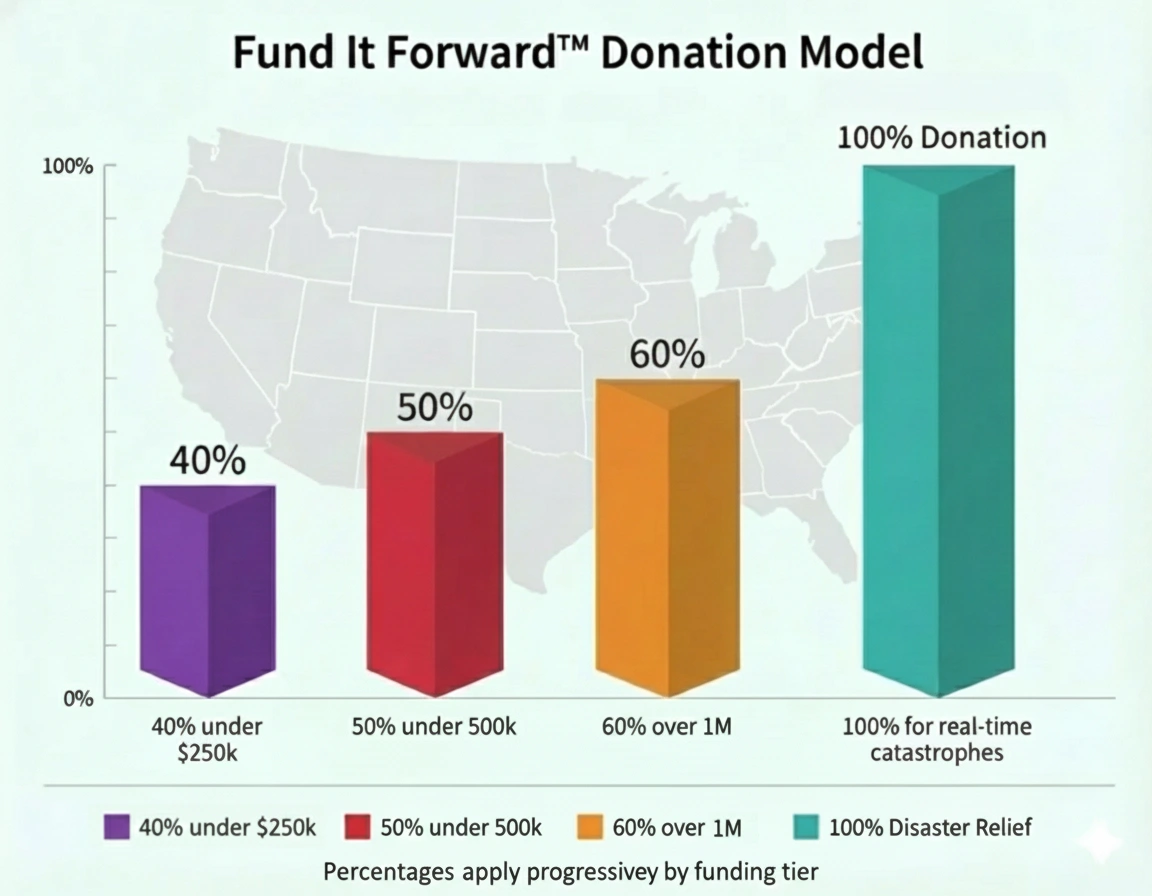

Built-in charitable giving for social impact and tax benefits.

BeneFund empowers ethical, transparent business growth. Our Line of Credit blends flexibility with purpose—helping you maintain healthy cash flow while contributing to community impact. Every draw and repayment supports charitable giving, turning your financial strength into meaningful change.